Create tailor-made products that fit each segment of the bank.

By leveraging our award-winning technology and operations, any size of bank can create custom investment products quickly and easily, gaining a competitive edge.

Empowering financial institutions to issue and distribute structured products, using the power of technology to support investment, advisors and treasury teams.

Harness the power of TECHNOLOGY and DIGITAL AUTOMATION to create personal investment products

Define your distribution strategy, your funding requirements and your target market.

Segment clients and explore their risk and investment appetite.

In real-time, manage the structuring and issuing processes, from automatic hedging to regulatory compliance and governance.

Produce all necessary documentation.

Monitor the live product from inception to maturity.

Integrate seamlessly with internal advisory dashboards, downstream systems and all interbank processes.

Automate internal workflows to reduce manual work.

Manage all products throughout their lifecycle.

Alert internal teams and clients about product events.

Upon maturity, offer clients new bespoke investments that fit the evolving economic environment and current market conditions.

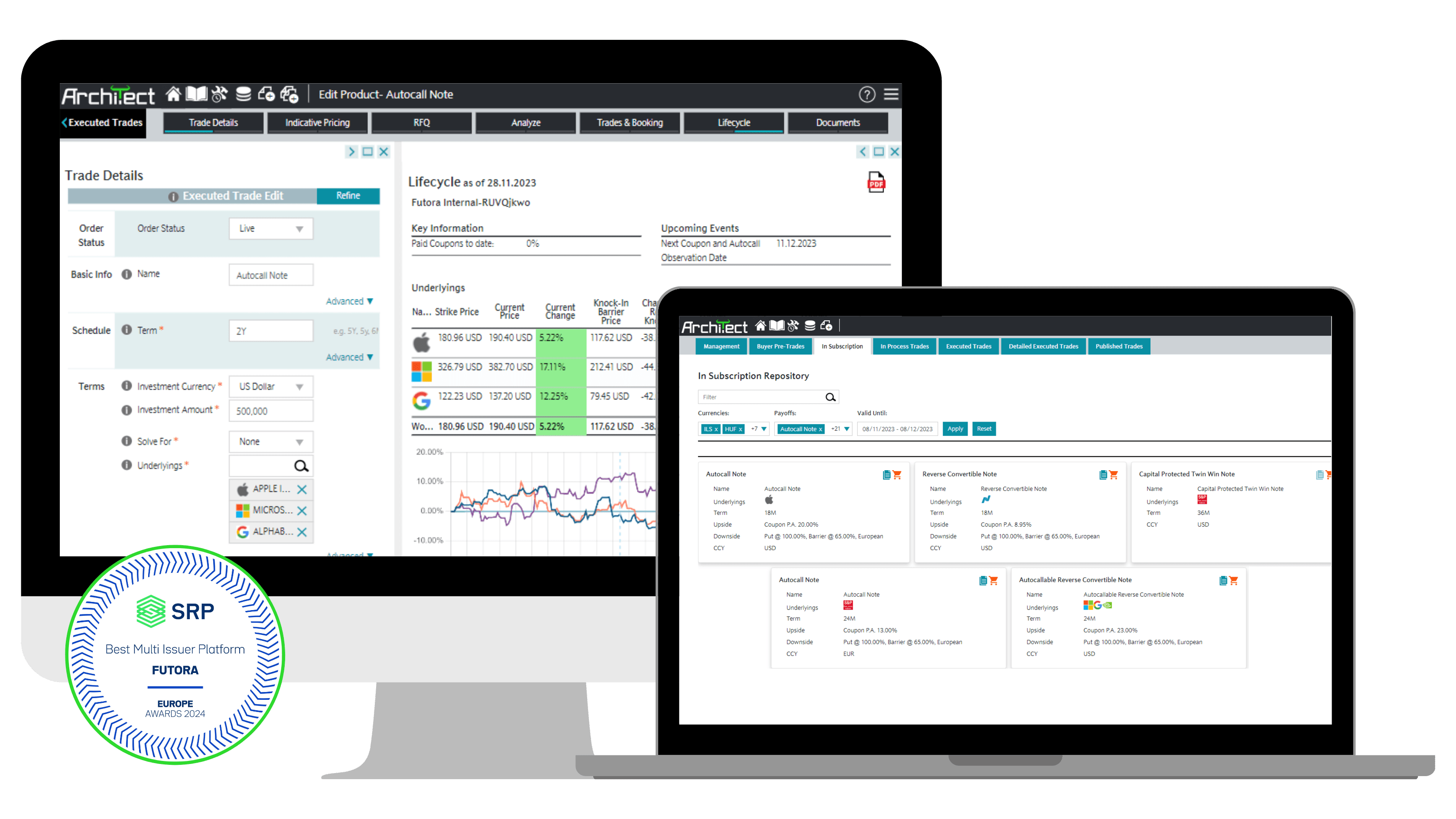

Futora has developed the most comprehensive and user-friendly front-end platform to access, price and manage structured products.

Futora’s platform provides robust and comprehensive pre and post- trade analytics including risk analysis, product testing and lifecycle monitoring for structured products.

Futora’s platform accommodates internal and external regulations and any specific product governance and compliance requirements.

Full operational suite to support entering the market, launching new products, managing existing products and more.

The solution’s back office technology is a fully customisable module that is configurable to accommodate any interbank workflow and information flow requirements.

Distribute your own products or third-party products internally to your network or externally with a whit label solution. Alternatively, join Futora’s marketplace.

Retail Banks are always looking for an alternative and cheaper way to raise funding, while trying to deliver an optimal customer experience.

Clients seek investments that meet their risk appetite, term requirements, exposure and many other factors.

Futora’s end-to-end solution transforms a bank’s investment and deposit proposition, allowing it to offer personalised investments to the mass market.

Imagine a world where you can offer investment products tailored to a retail client’s needs, regardless of their wealth.

Private banks compete to offer a more efficient and comprehensive service to high-net-worth individuals. Their clients expect a complete service, from advice on product selection to fast execution and efficient portfolio management.

Futora’s solution empowers private banks to access the structured product market, price various products and combinations, execute transactions seamlessly and distribute the products digitally.

Imagine an infrastructure where teams are connected seamlessly and processes are digitalised so you can offer the best services to your clients.

New-era banks rely on innovation and digitalisation to compete with traditional players.

Futora enables digital and neo banks to offer exclusive investments and deposits. Futora’s solution integrates with existing processes and allows a bank to offer personalised products to its clients, regardless of segment.

Imagine a world where clients can invest in bespoke products from a laptop or mobile device.

Banks can’t raise funds via notes (under EMTN) and simultaneously offer custom investments because they lack the technological capabilities to automate and streamline the processes involved. The only option is to offer a few campaign products that are costly to issue and don’t meet the needs of their entire client base.

Based on 15 years’ experience, Futora has developed technology to help a bank of any size to structure, issue and distribute structured products and manage their structured product business.

Imagine issuing your own structured products with considerably fewer resources and less effort, while boosting profitability.

Institutional investors seek high returns and the ability to assess various products that fit their risk/return profile and risk appetite. As they invest large sums, they expect efficient pre-trade support and fast execution.

Futora provides the technology to assess various trades and execute and manage live positions at the click of a button.

Imagine significantly reducing the time required to analyse and access the market.

Offer innovative investment products, stand out from the crowd and increase your client base

Our Latest Updates

| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |